Marketing Our marketing expenses consist.

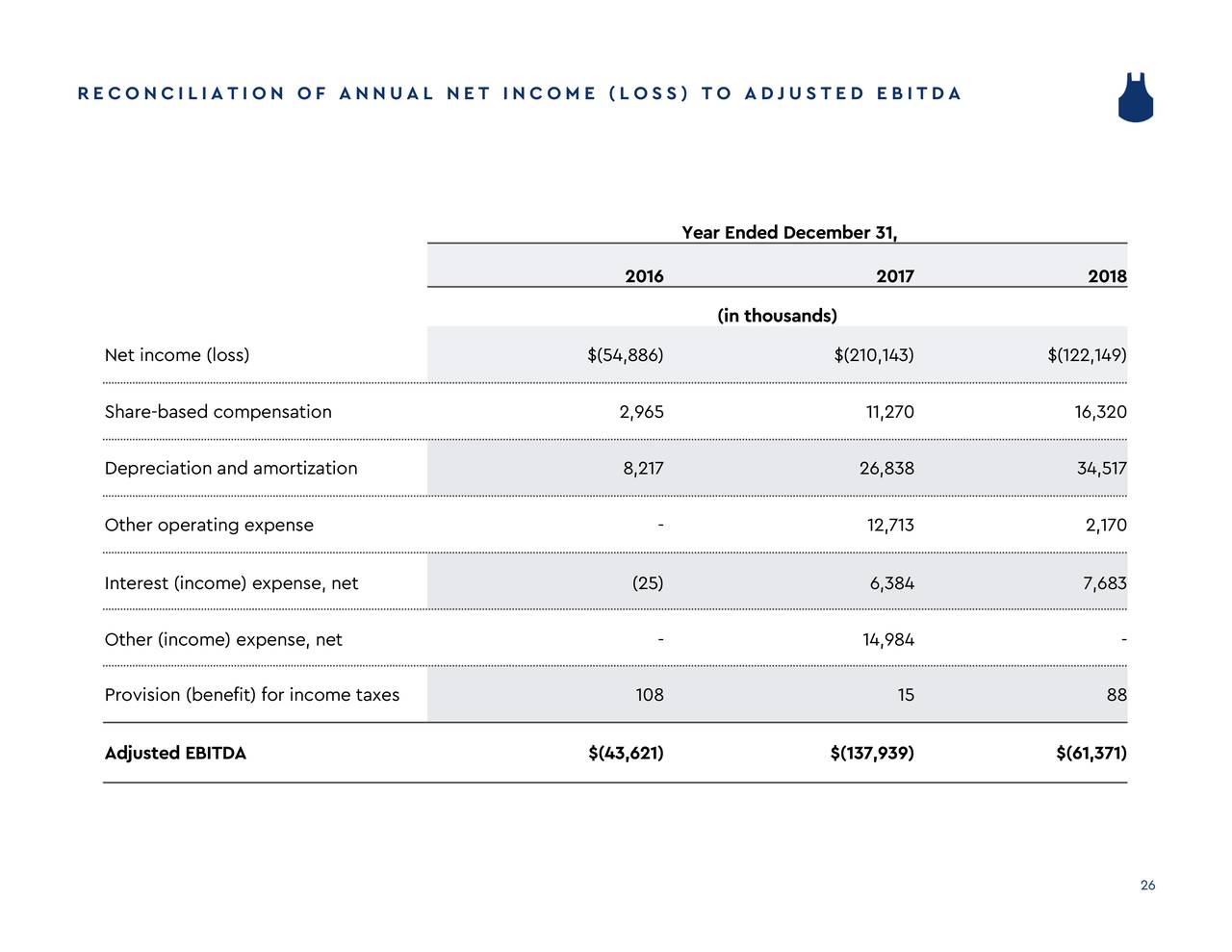

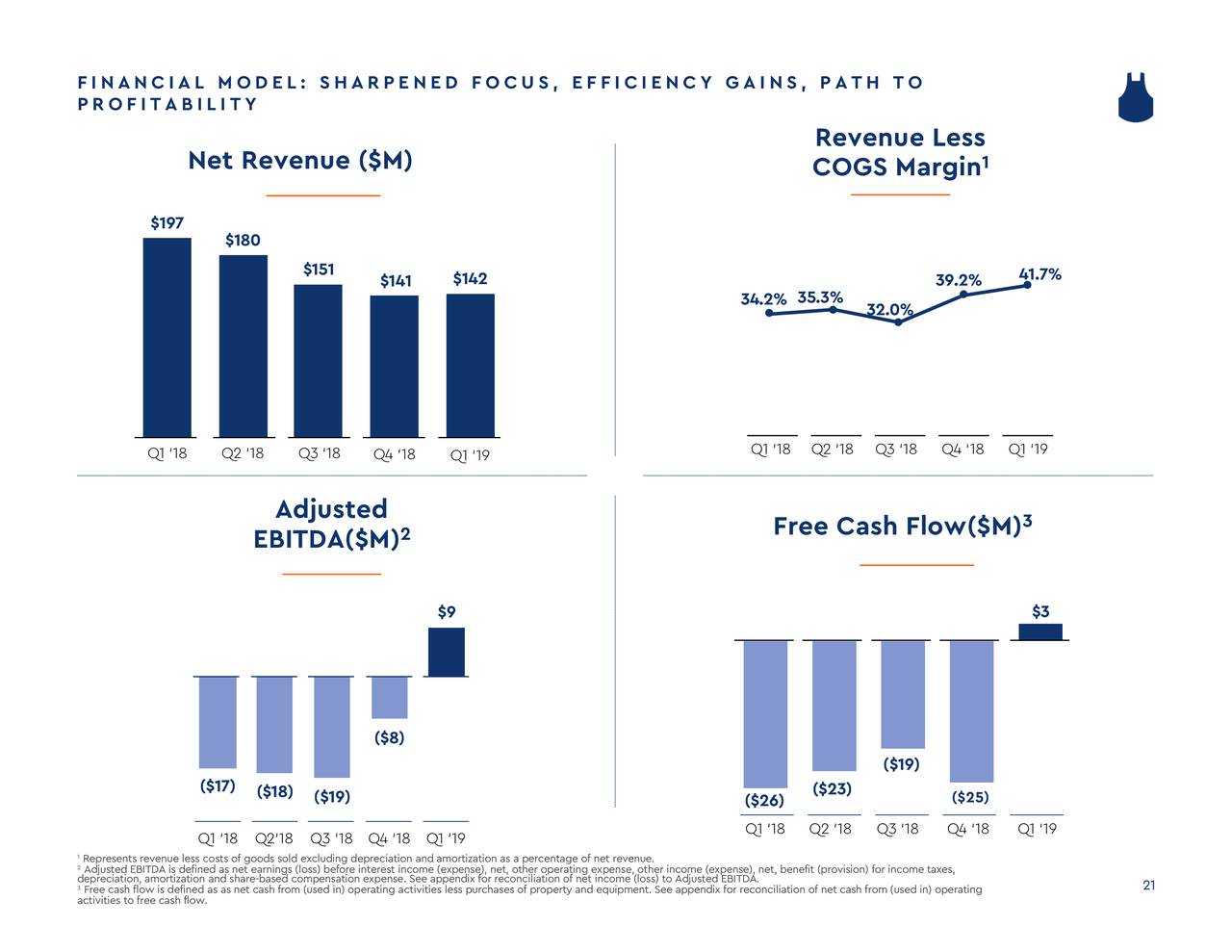

Read moreĪdjusted EBITDA Adjusted EBITDA is. Read moreīecause of these limitations, we. Read moreĪlso included in marketing expenses.

Marketing and Customer Lifecycle Management. Read moreĬhanges in operating assets and.

Read moreĪccordingly, we believe that adjusted. Read moreĭepreciation and Amortization Depreciation and. Please see "Non-GAAP Financial Measures". Product, Technology, General and Administrative. Read moreįulfillment costs consist of costs. We expect these expenses to decrease in absolute dollars in 2023 compared to 2022, as we realize savings from the corporate workforce reduction announced in December 2022 and continue to focus on expense management. Our cash requirements are principally for working capital and capital expenditures to support our business, including investments at our fulfillment centers, investment in marketing to support execution on our strategic priorities, and investment in marketing to support execution on our strategic priorities. The increase in net revenue was primarily due to an increase in Average Order Value and Average Revenue per Customer during 2021 as a result of both the continued execution of our then growth strategy, including through product innovation, and the changes in consumer behaviors relating to the COVID-19 pandemic. Operating Expenses Cost of Goods Sold, excluding Depreciation and Amortization Cost of goods sold, excluding depreciation and amortization, increased by $18.9 million, or 7%, to $301.8 million for 2021 from $282.9 million for 2020. Operating Expenses Cost of Goods Sold, excluding Depreciation and Amortization Cost of goods sold, excluding depreciation and amortization, increased by $2.8 million, or 1%, to $304.6 million for 2022 from $301.8 million for 2021. Other Inside Blue Apron Holdings, Inc.'s 10-K Annual Report:

0 kommentar(er)

0 kommentar(er)